Fandom creates a full funnel proposition for marketers. The acquisition of several media brands from Red Ventures is the latest step in this initiative.

On Monday, Fandom acquired GameSpot, Metacritic, TV Guide, GameFAQs, Giant Bomb, Cord Cutters News and Comic Vine from Red Ventures.

According to a source familiar with Fandom's finances, Fandom paid more than $50 million in cash in the bracket "in the mid-1950s."

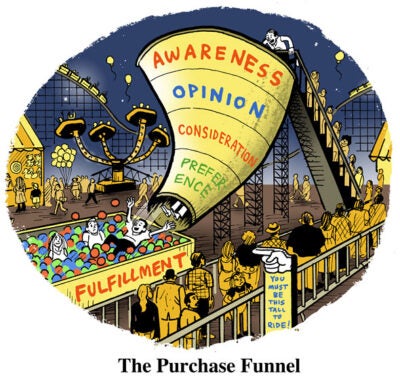

According to Fandom CEO Perkins Miller, the acquisition will strengthen Fandom's reach among fan communities and complement the offering as marketers navigate the marketing funnel.

"We have brands that draw you from different angles," Miller said. "We can meet the fan at different stages of the journey and offer advertisers a complete 360-degree journey package for the user."

For example, gamers can check GameSpot for upcoming releases, then go to Metacritic and Giant Bomb to check reviews before buying, Miller said. Promotional messages can be tailored to these users based on the sites they visit and where they are in their purchase journey.

According to Miller, Fandom expects the ability to implement intent-based marketing will also increase affiliate sales on Fanatical, the Fandom e-commerce platform it acquired in February 2021.

"Going from GameSpot, Metacritic, or Giant Bomb to Fanatical isn't a long way to get a game," Miller said. "So we think the connective tissue will be pretty strong."

While Miller declined to disclose the impact on Fandom's overall ad revenue, the new list of sites will have a "huge impact" on the company's bottom line, he said.

Data-driven segmentation

Miller said Fandom plans to use the acquisition to amass a larger portfolio of 350 million users and 50 to 60 million pages.

Fandom will track user behavior on the Site, including contextual information about sites visited, and use this data to enhance its FanDNA data platform.

Fandom uses these data points to create contextual targeting segments. These segments are typical fare such as "Harry Potter fans" or can be more esoteric, usually aimed at people interested in magic.

According to Miller, marketers can use the FanDNA platform to find similar audiences across Fandom's portfolio of sites. He added that this could be useful for entertainment brands looking to soften the blow in a market saturated with subscription deals and mainstream media.

How Fandom's new acquisitions will change the advertising experience remains to be seen. User-edited fandom wikis feature prominent "sticky" videos and ad units that maximize viewability and video completion rate (VCR).

These ad placements are the result of extensive testing in mobile and desktop environments "without sacrificing our commitment to maximum viewability," Miller said.

But Sticky Sections doesn't necessarily appeal to gamers, Fandom's core audience, and what's often seen as a picky, quick-to-use ad blocker. In response to criticism of its advertising practices, Fandom expressed concern that the company was saturating newly acquired sites such as GameFAQs, which glorified low-performing ads and minimalist designs with eye-catching formats and sticky ad placements. .

Instead of applying Fandom's wiki ads to its newly acquired portfolio of brands, Fandom will conduct a similar testing process for each of its media properties to find ads that deliver marketing KPIs without interfering with brand intent. . he said

"People find the path of least resistance to what they love," he said. "We certainly don't believe in 'one size fits all,' so we'll be doing similar evaluation with GameSpot, Metacritic and other groups to find the right foundation to build this ambition on."

According to Miller, Fandom expects a light touch from editors. He declined to speculate on editorial changes, layoffs or new mergers and acquisitions.

"The goal is to maintain good momentum and positive earnings for these companies over the last year," Miller said. "So the first task is not to break anything."