As self-service strips (SCOs) become more common in grocery stores and pharmacies across the U.S., Catalina's head of consumer intelligence has released a study that breaks down common generalizations about shoppers who don't like and use the SCO option. If they like it.

The growth of aisles in supermarkets

The number of SCOs in the U.S. has grown by 10% over the past five years, and Catalina estimates that they now account for about 40% of U.S. grocery chain work — a number that continues to grow as retailers like Walmart, Kroger and Dollar General offer typical store SCOs. It does, according to CNN. As more retailers take these steps in the US and around the world, Catalina recommends considering data from their shopper intelligence platform, which highlights that most consumers want manual and SCO options.

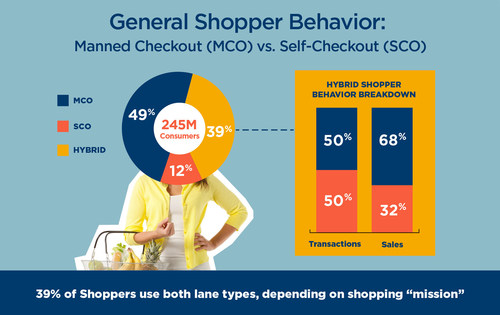

For this study, SCO Catalina divided shopper ID into three categories: SCO network, serviced checkout (MCO) network, and hybrid SCO and attended lanes. The path they use depends on the buyer's profile and buying potential. Surprisingly, more consumers switch from a dedicated SCO line to a manually operated line each year, but those who consistently use both have the highest retention rates and the most value for customers.

How job preferences relate to buying behavior

Catalina data shows that by 2021, 39% of shoppers will use both types of queues depending on their shopping mission. 49% of buyers prefer personal attention given to people only and only 12% of buyers are strong supporters of SCO only. Looking at the behavior of hybrid buyers, their business is split 50/50 between MCOs and SCOs, with MCOs accounting for 68% of sales and SCOs 32%.

Among other findings of the study, SCO specialty store shoppers have smaller shopping carts and make fewer purchases than hybrid shop and MCO enthusiasts. Instead of grocery stores, SCO consumers are more likely to buy groceries for their kitchens through other channels such as wholesale retail stores or online. By 2021, hybrid shoppers made the highest purchase price ($1,720) and made 36 shopping trips per year.

Catalina's analysis also shows that MCO's niche buyers are mostly baby boomers and silent consumers with household incomes under $100,000 and high school educations. SCO shopping attracts the silent generation as well as 19- to 24-year-olds. Those using the SCO and MCO bands are a diverse demographic mix and typically have annual household incomes over $100K, which is higher than other categories.

For each payment segment, Catalina analyzes the customer profile and upstream relationship. For example, those looking for natural flavors and avoiding nuts tend to use SCO bars more than other categories, while those looking for caffeine and avoiding partially hydrogenated oils choose MCO. Those who switch between the two look for ingredients.

"In our view, retailers must evolve to balance self-service checkout and people so they can adapt to a more multidimensional shopper profile, improve the customer experience, ensure cost efficiency and maximize sales over the long term," said Wesley. the bean US Executive Director. Catalina Retail Specialists. “Until now, buyer profiles have tended to group consumers based on demographics and where they were in the shopping channel. Retailers can now adjust checkout settings and shopper preferences to further personalize shopping and deliver important messages to individual shoppers.

Using coupons on SCO line

Catalina's research also refutes the traditional industry perception that shoppers won't waste time redeeming coupons in the SCO line, citing a pilot program launched at a local grocery store that measured the six-month performance of SCO shoppers versus customers who received the ad. S.C.O. . . Kay then measured post-promotion ROI versus the prior year based on two company regions and pay band types. They were surprised to learn that SCO customers who received coupons made four times more sales than SCO customers with limited benefits. Compared to the previous six-month period, these coupons increased sales by 181% compared to the control group, which increased by 40%. Data analysis shows that incentives attract new shoppers, engage previously absent shoppers and increase store visits.

Plan a long-term automation strategy.

Catalina concludes its SCO study with advice for retailers planning their long-term payment automation strategy. Offer includes:

- Carefully consider balancing SCO and MCO paths to maximize sales

- Use UPC level data to better understand how preference tracking relates to shopping behavior.

- Create multidimensional shopper profiles that include checkout preferences to attract new customers, non-buyers and increase store visits.

- Work with brands to personalize offers and improve their marketing mix based on when and how they shop in-store.

About Catalina

Catalina is a leader in shopper intelligence and in-store services, television, radio, podcasts and digital media that personalize the shopping journey. Using the world's largest real-time buyer database, Catalina helps retailers, consumer product brands and agencies optimize every step of media planning, execution and measurement to achieve $6.1 billion in customer value each year. Catalina has no higher priority than ensuring the privacy and security of data entrusted to the company and maintaining consumer confidence. Catalina operates in the United States, Costa Rica, Europe and Japan. For more information, visit www.catalina.com or @Catalina on Twitter.